Discover how easy it is to implement and manage conversational AI solutions in-house

According to a recent study published by the Financial Brand, financial institutions are “missing the mark on what consumers want, focusing on product and price as opposed to genuinely understanding the needs of customers.”

These mismatched expectations have created a disconnect between how banks and credit unions perceive customer service priorities and what their members actually experience.

The study highlights just how out of sync marketers are with consumer needs. Across four key customer service dimensions, the largest gaps appear in customer understanding (24%), personalization (21%), omnichannel consistency (21%), and privacy (17%).

Bridging these gaps requires advanced technology that can align institutional assumptions with real customer needs. Fortunately, sophisticated software can not only enhance user experiences instantly but also equip financial institutions with critical insights to drive meaningful improvements in customer service.

Boost.ai has perfected conversational AI for financial institutions with an all-in-one, easy-to-use platform that does not require coding or developer knowledge.

You can engage with your members on their terms, streamline internal processes, and deliver the instant customer service your customers now expect.

Keep reading to learn how end-to-end conversational AI can improve customer service and help your branch scale effectively.

In this article, you will discover:

- How boost.ai makes it easy to get started with conversational AI with 80% of inquiries and industry specific intents ready-to-go, right out-of-the-box.

- Why our platform makes it simple to implement, manage, and edit your virtual agent to increase customer satisfaction and streamline internal processes.

- How our no-code platform allows you to make changes instantly without reliance on data scientists or professional coders.

Now, let’s look at just how easy it is to implement conversational AI, train your virtual agent, and manage it all right at your fingertips.

Ease of management: conversational AI made easy

Let us worry about the technology, so you can worry about your customers.

We’ve taken the power to provide scalable self-service, and made it simple with:

- 80% of intents ready to go, right from the start

- Easy and instant updates your team can make in-house

- Simple, no-code interfaces on our all-in-one dashboard

- AI training tools, resources, and support that put your team in control

- Easy implementation that compliments your existing tech stack

- Unlimited scalability, thanks to highly intelligent virtual support

Let’s look at each of these perks in detail.

80% ready, right out of the box

Our solution is ready-to-use from day 1. We have pre-packaged industry modules with pre-built intents that address common banking questions like, “how do I change my account password?” or “how do I apply for a first-time home buyer loan?”

Routine inquiries can be effortlessly automated and handled by a virtual agent, enabling you to serve members instantly in a fresh, efficient way while quickly realizing the value of the solution. The remaining 10-20% of intents are unique to your company and brand, along with any additional customizations you'd like to include.

Business moves too fast to rely on vendors

One of the most common sentiments we hear from clients is that their internal processes change so quickly, they don’t have time to wait on a developer to make changes or go back and forth with vendors every time a minor change is made.

With our conversational AI software, there is no waiting, no back-and-forth, and no wasted time. For clients that move “too fast” for traditional chatbot integrations, our conversational AI is the ideal solution to make instant changes anytime you need.

With boost.ai, you’re in control. Whether it’s updating a question, adjusting a customer flow, or refining an internal process managed by your virtual agent, your team can make changes instantly—no need for expert assistance.

No coding, no data scientists

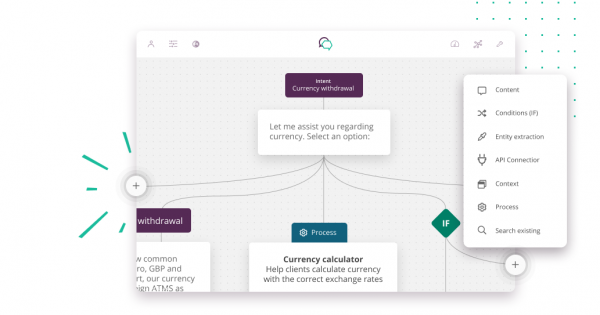

In addition to full independence over your chatbot, our platform is so intuitive that it doesn’t require data scientists or coding knowledge to experience the full benefits.

Our no-code chatbot builder gives you everything you need to create advanced conversation flows in minutes. Unlike other platforms that are slow and clunky, our sleek no-code platform gives your institution all the benefits of having a highly sophisticated team of data scientists without the need to hire a brand-new department!

Anyone can be an AI Trainer

With no need for data scientists or a fancy tech team, who maintains your virtual agent?

You do! Or, more specifically, any employee appointed as your AI Trainer!

An AI Trainer maintains and updates your virtual agent. Having someone in-house to oversee your chatbot makes it so that necessary changes can happen quickly with little to no disruption to your members or internal processes.

The boost.ai support team is with you every step of the way, offering training videos, articles, and certification courses to help you master your virtual agent. Your AI trainer has all the tools needed to update and maintain it effortlessly. Fun fact: every boost.ai employee completes this training when they join the company!

Fits with your existing tech stack

Boost.ai designed a conversational AI platform that fits in with your existing tech stack and processes. We integrate with your core banking system so you can keep using the systems that work and enhance the ones that could benefit from automation.

We enable financial institutions to provide a true omni-channel strategy. Our virtual agent is not just compatible with your existing tech stack AND your website, but it can also be integrated with popular platforms, such as your CRM, to provide greater value for both employees and members.

Easy-to-use dashboard

With our actional status board, you can easily see a complete overview of how your virtual agent is performing, track conversion quality, member feedback, and other stats that allow you to continually monitor and optimize user experience.

The AI Admin Panel gives you an in-depth look at conversation analytics and virtual agent interactions. You can easily access data based on quality rating, tagging, filters, and more. Additionally, detailed messaging analytics gives you a breakdown of each message history, including predictability score and word choice.

Unlimited scalability

Natural Language Processing (NLP) and Natural Language Understanding (NLU) allow your virtual agent to answer questions and automate actions on thousands of topics, with consistently high-resolution rates.

One of the biggest concerns we hear is that a virtual agent will sound too automated, impersonal, and cold. This was a common problem with Gen 1 chatbots, which were infinitely less intelligent than our current technology.

When conversational AI is backed by NLP and NLU, your virtual agent is unstoppable. These processes allow your virtual agent to learn and understand conversation flows, giving it the ability to strengthen vocabulary, add nuance, and become more naturalistic in its responses as it gains experience.

Ease of management = ease of use

Your members expect tech-savvy solutions that are right at their fingertips.

To help financial institutions remain competitive and deliver the kind of service their members want, we’ve created a revolutionary conversational AI platform that is built for institutions like yours.

We remove the barriers to entry, give you in-house control, and make it easy to get started with a comprehensive solution that saves time and money while also increasing member satisfaction. What could be better than that?

To illustrate how much of a win-win conversational AI is for both members and employees, keep reading to learn how boost.ai transformed MSUFCU’s customer service through the power of conversational AI!

Case study: Michigan State University Federal Credit Union

MSUFCU launched a virtual agent in just 10 days, automating 2,000+ internal interactions

In 2020, MSUFCU teamed up with boost.ai to launch a virtual agent pilot program to assist credit union employees with automating backend processes, while also improving front-end customer service interactions to assist member support staff.

“Boost.ai’s user-friendly software makes it easy to analyze conversation data and use it to make the chatbot more functional.”

— Benjamin Maxim, VP Digital Strategy & Innovation, MSUFCU

Ready to get to work?

The modern tech solution you need to stay competitive & increase customer satisfaction

As a leader in chatbot technology, boost.ai has revolutionized how credit union and banking customer service departments provide scalable, reliable, and personalized self-service. To deliver the kind of service your members expect, conversational AI is the ultimate, tech-savvy solution.

Boost.ai’s solution extends beyond financial services, serving industries like telecommunications, insurance, e-commerce, and more. If you want to deliver fast, accurate, and seamless customer service, boost.ai can help you meet expectations and effortlessly maintain customer satisfaction.

Further support

For more information on how boost.ai can improve your customer service operations, check out the following resources: